Ironfly Prime

Our Comprehensive, End-to-End Investment Management Solution

Enabling Hedge Fund professionals to more efficiently and effectively manage their investments

Our flagship product, Prime OEMS, helps clients achieve top performance in the most demanding market conditions.

Large and growing institutional clients insist on ultra-high availability and resilience across multiple asset classes, counter-parties, and time zones. Our OMS/EMS platform delivers exceptional performance, offering portfolio and trade management with full control over the entire trade lifecycle.

Prime OEMS: Solutions For The Full Trade Lifecycle

Strong businesses are built on strong foundations. Prime OEMS is based on institutional-grade technology according to rigorous industry standards. It provides a strong technical foundation on which to build your growing business.

Workflow Support

-

Prime OEMS offers support for all major market data providers. Prime (and all Ironfly solutions) can incorporate real-time market data, analytics, and any other proprietary data or information source clients may require.

-

System availability and resilience is an under-appreciated yet critical factor in the success of a hedge fund or asset manager. Prime OEMS delivers ultra-high availability. Ready when you are.

-

The Ironfly platform provides secure, encrypted access, including 2-factor authorisation. Flexible user enablement and access procedures are supported. Supervisory features and multi-role permissioning can also be applied, as well as individual and group-level user permissioning.

-

The Ironfly team provides 24X6 trading desk and ops support. With our additional services and client-first philosophy we become an extension of your team.

How you start often determines how you finish. The Ironfly team actively monitors and manages systems to ensure your start-of-day processes perform as expected. This lets you focus on what is important: identifying and acting on opportunities and delivering high performance.

Pre-Trade Workflow

-

Prime goes beyond the standard position blotter, allowing you to review, manage, and monitor fund holdings in real-time. From SOD position import/load (from all sources) to allocations and post-trade exports. End to end, and everything in between.

-

Keep track of asset allocations and performance, across asset classes and in real-time. Apply charts and filters (configured to your preferred workflow) across your positions, incorporating historical, live, and 3rd party data, to uncover key, up-to-date insights.

-

The risk management rules engine supports multi-stage compliance monitoring and pre-trade risk/exception alerts. Create an ideal mix of firm-wide compliance and regulatory checks, market or product-level hard and soft limits, per-user fat-finger warnings; or cross-team notional value restrictions.

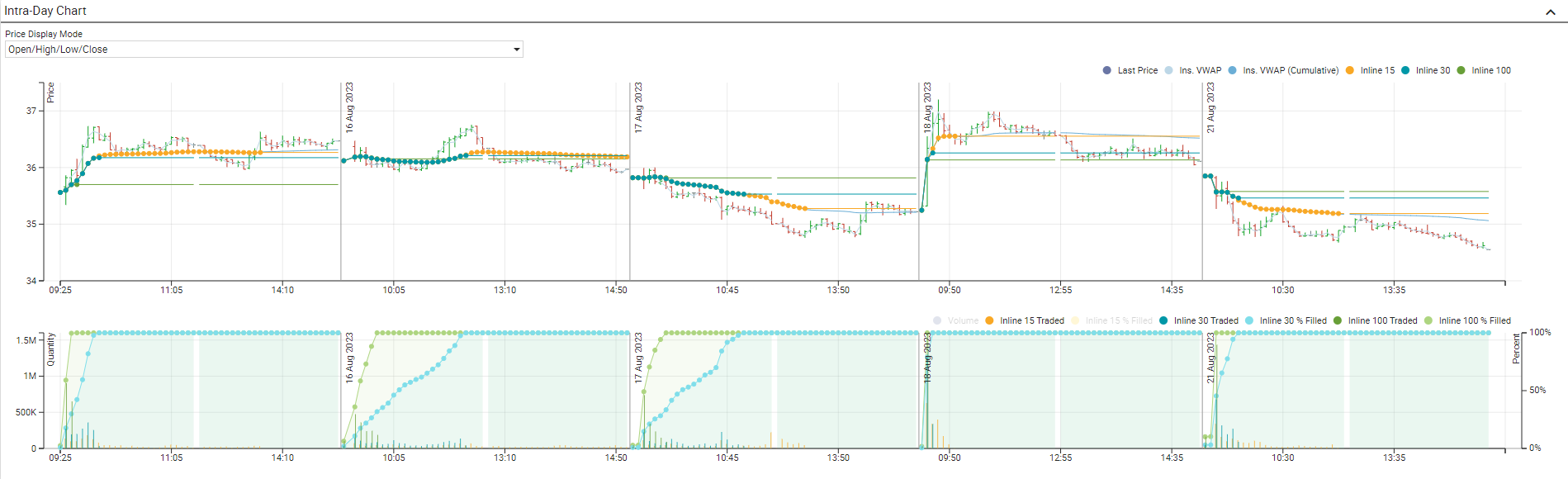

Great investment ideas depend on great execution. An effective order management and trading workflow can make or break fund performance, from broker and algo selection to execution quality monitoring and performance tracking.

Trade & Execution Management

-

Prime provides a fully integrated stock loan and inventory management solution. Securing borrows manually is time-consuming and error prone. Integrating this directly into the trade ticket saves time, reduces costs, and prevents short selling without the required borrow.

-

Ironfly offers extremely cost-effective access to hundreds of executing brokers, liquidity providers, and trading venues. Full support for low-touch DMA, algorithmic trading, and high-touch “care” desk access is provided. Trading access covers multiple asset classes and regions/global markets.

-

The platform provides automatic and live calculation of estimated commissions and fees. This enables you to optimise your broker selection and trade management, for better cost control.

The investment process doesn’t end when the market closes. Your investment management solution must be available whenever global markets are active. Your operations team also contributes to performance when they have streamlined and reliable post-trade systems and procedures.

Post-Trade Workflow

-

Numerous reporting and data export options are provided with full support for custom reports and integrations. These cover real-time portfolio level or trade/execution-related data; pre-scheduled or ad-hoc/on-demand report generation is available, and formatted to your specific needs.

-

Display metrics presets or custom analytics to apply performance analysis on current and historical holdings. Perform multivariate analysis leveraging the different visualisation types for a mix of aggregated and/or tabular information.

-

Live, interactive data visualisations of portfolios, positions, orders, and trades enable you to intuitively surface outliers or key exposure points. It provides the insights you need when you need them. These fully customisable screens also let you interact with and drill down on that data.

-

The fully customizable, multi-window desktop UI is equally performant on low-spec machines (eg laptops). Ironfly also provides iOS and Android mobile device support, ensuring your team has a complete view of your investments wherever they go.

Prime provides a full battery of asset management tools to manage and monitor portfolio holdings, orders, and executions, and supports multi-assets trade routing to a global list of brokers and markets.

See How Ironfly Helped a Large Hedge Fund Improve Their Trading Workflow and

Dramatically Reduce Total Cost of Ownership >

Case Study: Full OEMS Displacement

For a Major HK-Based L/S Fund